At the time of publishing this post, the current interest rate for SBA is 6.55% on purchase and construction loans. Investor loans for retail properties are in and about 6.45% at 60% LTV. This information is for general reference purposes only, please consult with a knowledgeable commercial lender for the most accurate loan scenarios.

The areas included in this summary are the interior Contra Costa Counties and Alameda Counties. Generally stretching Martinez south to Fremont along the I-680 corridor and include San Ramon, Danville, Livermore, Pleasanton, Concord, Pacheco and Martinez.

How have the retail strip centers performed since interest rates began climbing in mid 2022?

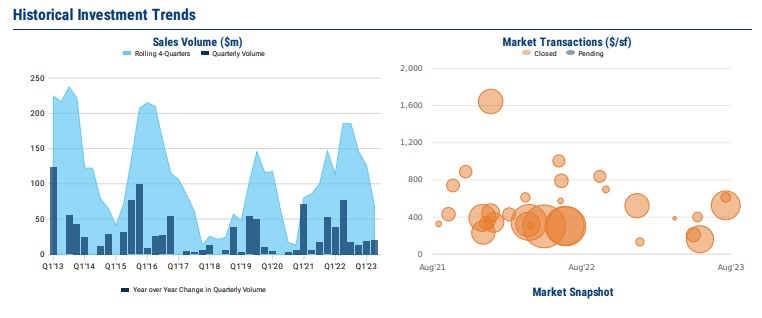

To put it lightly, sales have slowed. Year over year, there is a 62% decrease in individual retail strip center sales. There have been approximately 8 retail strip center sales in 2023, year to date **. However, this does not include smaller retail buildings or condos that are under $1,500,000.

**Information and charts provided by MSCI Real Capital Analytics

What is the Result as for Pricing?

With such little inventory actually selling, the full calculation of the interest rate increase has yet to be absorbed in the sales price of assets. Prices remain fairly steady, with insignificant discounts. Median price per foot remains above $400 per square foot, generally speaking, although comps have a wide disparity between $211 and $612 per square foot. Cap rates on these properties are generally unpublished. That said, we are able to approximate a few properties sold:

Net Leased Investment Category:

200 Golf Course Road, Pleasant Hill occupied by Floor & Decor – $16.1 Million sale price, 6.18% cap rate

505 Contra Costa Blvd., Concord/Pleasant Hill occupied by O’Reilly Autoparts – $2.25 Million, 5.78% cap rate

Traditional Strip Center:

Located at 1200 Contra Costa Boulevard, Concord traded hands in May 2023. The center was reported at 90+% occupancy with a sale price of $401 per square foot ($3.8 million) with an estimated cap rate of 5.22%

Retail Properties Under $2,000,000

Smaller assets priced under $1,500,000 to $2,000,000 continue to trend at $500 or more per square foot and cap rates under 6%. There are quite a few sales at The Well in Livermore, located on Concannon Boulevard, both leased investment and owner/occupant sales between $530 per square foot and well over $600 per square foot. Small assets continue to defy interest rates given this is the entry level price point for buyers seeking to leave the residential landlord space and enter to the commercial landlord title.

Leave a comment